A guide to the $6B coming to Maine in the massive stimulus bill

By Lori Valigra, Bangor Daily News Staff

Maine can expect substantial benefits from the new coronavirus stimulus package signed into law by President Joe Biden on Thursday, with more than $6 billion coming in for various programs, according to an estimate.

Democrats are heralding the $1.9 trillion American Rescue Plan as a major victory with widespread support from the public. However, Maine’s congressional delegation was split, with Republican Sen. Susan Collins and Democratic Rep. Jared Golden voting against it while independent Sen. Angus King and Democratic Rep. Chellie Pingree backed it.

Exact breakdowns of aid coming to the state are not yet available, but the Maine Center for Economic Policy estimates the state could get “well north of $6 billion.” Most is in the first year of the program, although some aid extends over two or more years. The center based its figure on estimates from the House Committee on Oversight and Reform as of March 8.

Some of the more immediate benefits to Mainers are the extension of the $300 weekly unemployment benefit set to expire March 14, direct payments to Americans starting at $1,400 and major tax changes benefiting low-income people. Maine will see money for hard-hit industries. Among the winners are restaurants, which can apply for direct grants. Maine also stands to get large sums for broadband expansion and infrastructure.

“I think putting money in the pockets of Mainers to spend is one of the best things the bill does for our businesses.” James Myall, an economic policy analyst with the liberal Maine Center for Economic Policy, said.

Here is a breakdown of what Maine can expect:

$1 billion for state government, plus more local aid

The package designates a total of $350 billion for states, cities, tribal governments and U.S. territories. Of that, Maine’s state government should get about $1 billion.

Dana Connors, president of the Maine State Chamber of Commerce, said Maine already has laid out its economic recovery plan focused on stabilizing and supporting Maine’s people, employers and infrastructure, and the new money should be used to advance that plan.

“Helping to grow our economy through wise investments that follow the strategic plan … will get us where we need to be sooner,” he said.

Still, not everyone is happy with the amount for states, which was calculated differently in this COVID-19 relief plan than in previous bills, favoring states with high unemployment. That is one of the objections raised by Collins, who noted that Maine would gain $155 million under the old formula since unemployment here is relatively low.

Maine’s largest cities will get a total of $118 million, with metropolitan Portland getting the most at $48 million followed by Lewiston at $22.8 million, Bangor at $21.1 million. Auburn at $14.2 million and Biddeford at $11.7 million. Other cities and towns will share $115 million.

The state’s 16 counties will get $261 million, with Cumberland and York getting the largest chunks at $57.2 million and $40.3 million, respectively.

Stimulus checks and major tax changes

The latest stimulus will give many Mainers a third round of direct payments starting at $1,400 for single tax filers earning less than $75,000 a year in gross income and heads of households who earn less than $112,500. Married couples earning less than $150,000 jointly can expect $2,800. Dependents get $1,400 each. Single filers earning more than $80,000, heads of households earning more than $120,000 and married couples earning more than $160,000 will not get money.

The rescue plan temporarily increases the child tax credit for 2021 tax returns for many families to $3,000 per child aged 6 to 17 and $3,600 for every child under age 6. That’s up from $2,000 for 2020 tax returns. The credit is fully refundable, and it’s possible to get half of the credit in advance by having the Internal Revenue Service send monthly payments from July to December 2021.

The direct payments could make a huge difference to families, especially lower income earners. A family of four making less than $150,000 could receive at least $14,000 in federal aid this year, according to a Raymond James calculation. That would include the $2,400 in January from the previous pandemic stimulus, plus $5,600 from this bill. A new child tax credit could add another $6,000 per family.

The bill’s new child tax credit, earned income tax credit and cash payments together could increase the incomes of the bottom 20 percent of Americans by an average of 33 percent, according to the liberal Institute on Taxation and Economic Policy. Under the bill, those making less than $23,100 would save $2,080 in taxes, or 17 percent of their income, with the federal cash payment, although all tax brackets would see some tax benefit. They also would save an average $1,010 with the new child tax credit and another $360 on the earned income tax credit.

Unemployment help

One of the most contentious parts of the stimulus bill was the extra $300 per week on top of a claimant’s weekly benefit amount under federal enhanced unemployment benefits. That was knocked down during deliberations from $400 in earlier versions of the bill. The benefit is extended through Sept. 4.

Claimants were previously eligible for up to 50 weeks of enhanced benefits, which has been extended to 79 weeks through Sept. 4. The extra money will be added automatically to existing claims, according to the Maine Department of Labor. If claimants already used 50 weeks, they can start to certify for the extended benefits beginning March 21.

The Pandemic Emergency Unemployment Compensation program, which has provided up to 24 weeks of additional benefits to those who exhausted their regular state Unemployment Insurance benefits, will now have benefits for up to 53 weeks through Sept. 4.

The Maine Department of Labor said Thursday that it has paid out nearly $2 billion in federal and state unemployment benefits between March 15, 2020 and March 6 of this year.

Both the state supplemental budget approved Friday morning and the federal rescue plan include $10,200 of tax relief for unemployment claimants.

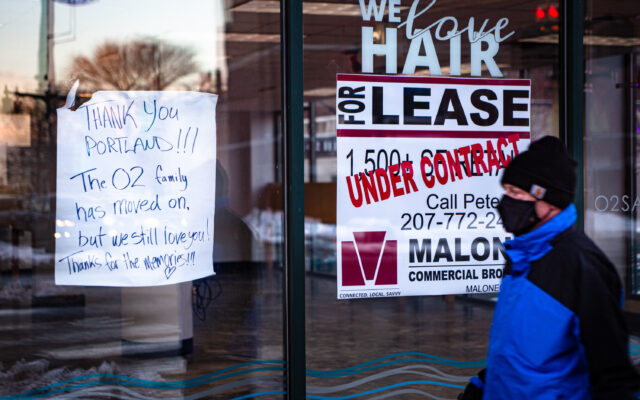

Restaurant grants

Some $28.6 billion in grants is available nationally for restaurants with pandemic-related revenue declines in 2020. Companies cannot own more than 20 restaurant locations or be publicly traded. Qualifying companies can get grants equal to their revenue losses up to $10 million per company and $5 million per location.

The grants will make the difference in whether some restaurants survive in 2021, said Greg Dugal, director of government for HospitalityMaine, an industry group.

“Those with high fixed costs like rent, mortgage and utilities based on high property values are the most vulnerable,” he said.

He expects grants will be used to help restaurants transition back to normal, with closed restaurants buying inventory to reopen, restaurants ramping up from the slower winter season, for payroll and to hire people.

Dugal also hopes that some state stimulus money will be allocated to a state grant program like last year’s Maine Economic Recovery Grants or the Tourism, Hospitality and Retail Recovery Grants.

Other business grants

The relief bill also allocates $7.25 billion nationwide for the Paycheck Protection Program, a program originally championed by Collins, and $1.25 billion more for a grant program for theaters and other venues that have closed and can get money equal to 45 percent of their gross earned revenue. The bill also includes $15 billion for federal Targeted Economic Injury Disaster Loan Advance payments.

It is not clear how much of that money will come to Maine businesses because the grants are competitive, Myall said.

The Paycheck Protection Program has been a popular way for businesses to get a forgivable loan for payroll and certain operating expenses. More than 10,000 businesses in the state have taken out more than $700 million in loans, according to the Small Business Administration, which oversees the loans. The bill also expands eligibility for nonprofits and digital news outlets.

Expanding broadband

The bill sets aside $10 billion in broadband funding for states, localities, territories and tribal governments to improve broadband infrastructure, with some $100 million expected to go to Maine.

Another $7 billion will go toward expanding educational connectivity and remote learning.

Support for agriculture and the food supply

Some $4 billion nationwide will address major pandemic-related disruptions throughout the food supply chain.

It will go toward investments in new infrastructure for farmers, food processors and farmers markets to build resiliency and support small meat and poultry processors. The money also will go toward monitoring COVID-19 in animals.